Discover Dyno Petro's Intelligent 4-Lease Strategy

Leverage our patented drilling technology for stable returns in a high-demand industry. Invest with confidence and capitalize on the steady growth of U.S. energy.

Addressing the U. S. Oil &Gas Production Shortfall

OPEC+ production cuts continue to mean less oil is being produced globally than is being consumed, and oil is being withdrawn from inventories.

Top 5 oil(1) producers and share of total world oil production(2) in 2023(3) United States 22%

Saudi Arabia 11% Russia 11%

Canada 6% China 5%

Oil & Gas Redefines the term "Economic Impact"

According to the International Monetary Fund, total fuel subsidies exceeded $7 trillion in 2022, accounting for more than 7% of global GDP.

Renewable Energy offers very good fossil fuel alternatives for electricity, but cannot meet the many transportation and industrial needs and uses that Oil &Gas c

Dyno Petro's Quad 25 Market Opportunity

Estimated Reserves of $150 billion USD

Estimated Reserves of $50 billion USD

Estimated Reserves of $10 billion USD

Estimated Reserves of $2 billion USD *

QUAD 25 Aggregate Estimated Reserves of $212 billion USD

Our Competitive Advantage

Unique ability to secure valuable mineral rights land leases through relationship-building with land owners.

Nimble, efficient Team that can act quickly on lease purchases, and operations - No lengthy board approval processes

Dyno Petro owns the patent for an oil discovery technology that has a 98% success rate for identifying high yielding wells. We believe this will fast track operations and save considerable money often spent on lesser producing wells

Our Strategic Advantage

By targeting financially distressed energy assets that immediately benefit from operational improvements we are able to predictably and reliably produce cash flow at a 10-17% lower cost.

We have invested millions of dollars in developing a model that accurately identifies Proved Undeveloped (PUD) drilling locations in established producing fields, avoiding risky wildcatting ventures.

By focusing on proven, undeveloped drilling locations in established oil fields with high projected monthly recurring cash flows we will consistently deploy assets on wells with a payback period of 9-18 months and lifetime cash flows of 10-20 years.

Along with the above mentioned model, Dyno Petro's patented oil discovery technology, to date, has identified 7 out of 7 high yielding wells. Our scans have delivered 95-98% accuracy, which could fast track operations and save considerable money often spent on lesser producing wells.

An Ounce of Prevention...

By simply avoiding 20 non-producing, or low-producing wells, we will save approximately $80 Million USD annually.

That's $80 Million that can be better deployed in high yielding wells,

or the acquisition of prime property leases.

Investor Models

Current Offerings

Participation through existing Notes

Participation through existing Private Placements

Hybrid Model

Debt and/or Equity Model with Option for future equity participation

Will include Conversion Option for 2026 Refinery

DYNO PETRO 2.0

Plans for the Dyno Petro Refinery

Dyno Petro is already in the planning phase for a multi-function refinery.

Our mission is to have our formal plans and funding secured by mid 2026.

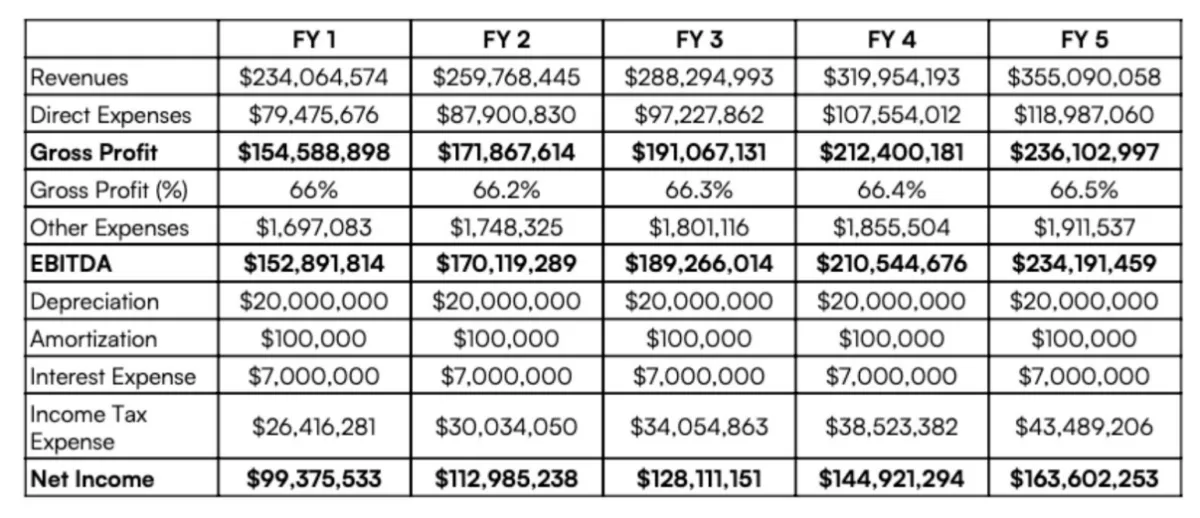

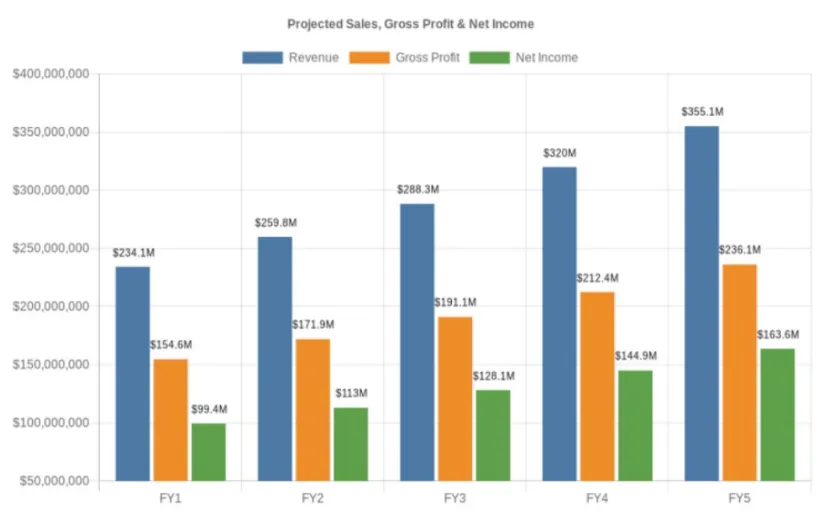

Financial Overview

Below is an overview of our expected financial performance over the next five years:

The above projects are based only on the CA and 1st LA Property, which represent only 25% or the potential wells for production, and do NOT include the two other QUAD 25 representative leases (LA2 and MS properties). Projections assume $70/barrel oil; $3 Mmcf/nat gas

Financial Projections Dyno Petro, LLC Business Plan

Projected Sales, Gross Profit

& Net Income

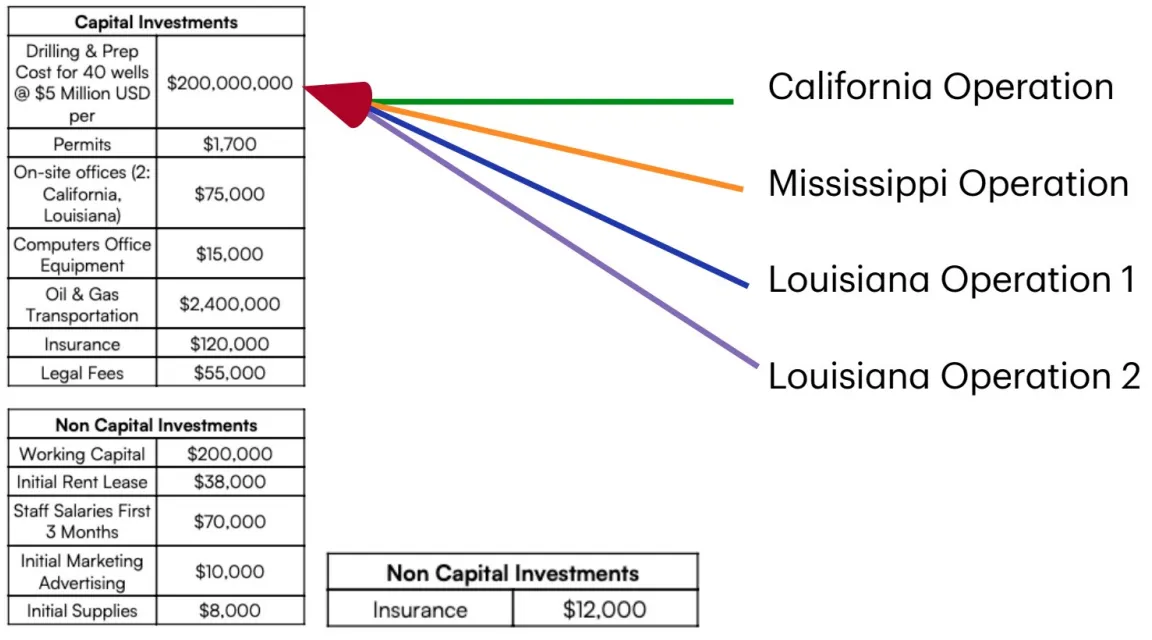

Funding Requests

To accomplish our growth goals, Dyno Petro, LLC needs $203 million in funding.

Key uses of this funding will be as follows:

Unique Investment Options

Enhancement on current

15% APY Note Offering:

To include Redemption Option at the end of 12 months (Very uncommon in the Oil & Gas investment space)

Capital Enhancement after 100 well milestone is met for up to $3 Billion USD in funding (per LOI), which early investors can participate in.

Straight Equity Participation in QUAD 25

Dyno Petro was founded with a vision to combine cutting-edge technology with decades of industry experience.

Our team has worked across the U.S., managing assets that produce anywhere from 200 to 2,000 barrels per day.

We’ve invested millions in exclusive technology, making us uniquely positioned to offer reliable, profitable oil and gas investments.

Copyrights 2024 || Dyno Petor LLC | Terms & Conditions

DISCLAIMER

This website contains predictive or “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of current or historical fact contained in this website, including statements that express our intentions, plans, objectives, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “should,” “would” and similar expressions are intended to identify forward-looking statements.

These statements are based on current expectations, estimates and projections made by management about our business, our industry and other conditions affecting our financial condition, results of operations or business prospects. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties.

Factors that could cause such outcomes and results to differ include, but are not limited to, risks and uncertainties arising from: our ability to raise sufficient capital to execute our business plan; expectations for the clinical and pre-clinical development, manufacturing, regulatory approval, and commercialization of our pharmaceutical product candidate or any other products we may acquire or in-license; our use of clinical research centers and other contractors; expectations for incurring capital expenditures to expand our research and development and manufacturing capabilities; expectations for generating revenue or becoming profitable on a sustained basis; expectations or ability to enter into marketing and other partnership agreements; expectations or ability to enter into product acquisition and in-licensing transactions; expectations or ability to build our own commercial infrastructure to manufacture, market and sell our product candidates; acceptance of our products by doctors, patients or payors; our ability to compete against other companies and research institutions; our ability to secure adequate protection for our intellectual property; our ability to attract and retain key personnel; availability of reimbursement for our products; expected losses; and expectations for future capital requirements.

Any forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise thereafter, except as required by applicable law. Investors should evaluate any statements made by us in light of these important factors.